IMAGE COPYRIGHT GETTY IMAGES

By Kevin Peachey

Personal finance correspondent

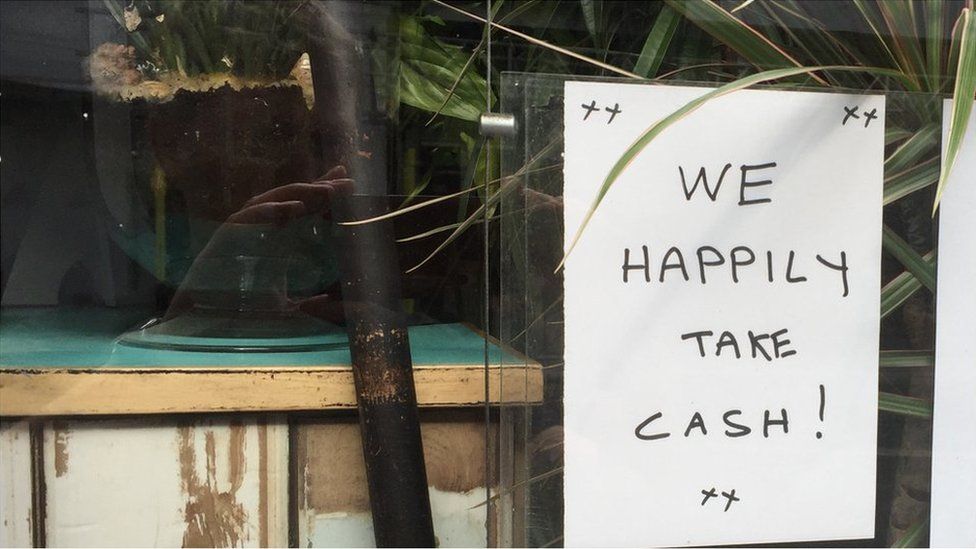

A refusal to accept cash is “creeping into the wider UK economy”, an expert has said, after a survey suggested coronavirus had hastened a shift towards a cashless society.

Consumer group Which? said that 34% of people asked said they had been unable to pay with cash at least once since March when trying to buy something.

Grocery stores, pubs and restaurants were most likely to refuse.

Natalie Ceeney, who wrote a report on the issue, called for ministers to act.

“The figures show that it’s not simply the odd coffee shop going cashless, but this is creeping into the wider economy,” said Ms Ceeney, who wrote the Access to Cash Review.

“We can’t just blame individual businesses – many are going cashless because they can’t easily bank cash takings because their local branch is closed or some distance away. The government needs to urgently legislate to protect the viability of cash – as it promised to do so last year. Time is running out.”

Which? said the lack of cash access was a problem for those who relied on notes and coins – such as people with certain health conditions or without computer access.

Jenny Ross, Which? Money editor, said: “We have repeatedly warned about the consequences that coronavirus will have on what was an already fragile cash system, but nowhere near enough action has been taken by the government or the regulator to understand the scale of this issue.”

The Treasury has proposed giving the City regulator, the Financial Conduct Authority, control of overseeing future access to cash and has thrown its weight behind the idea of cashback in shops, without the requirement to buy anything.

David Fagleman, director at financial consultancy Enryo, said: “Our own research shows that despite a decline in use for day-to-day purchases, nearly three-quarters of people think the move to a cashless society is happening too fast and risks leaving some people, particularly the vulnerable, behind.”